08 Sep, 2017

Financial Services Franchise

In the finance world, the securities lending only means the lending of the securities or stocks by a certain participant into another. The basic terms of such loan are then administrated by the lending agreement compelling the borrower to give the lender some sort of collateral. It could be with cash, credit letter, government securities, equal or one, which is higher than the value of the securities being lent.

The lending agreement is a legal contract enforceable under the state law, as with every agreement. Participants will then agree upon the set fee, being figured as the percentage charged every year, based upon the aggregate worth of the securities being loaned. It will serve as the payment for the loan itself. So, if you are thinking about getting financial services franchise, there are many things that you have to consider. Here are some of the important things that you ought to know for starting this kind of business:

• The accepted mode of collateral needs to be cash. The fee could be in the rebate form that will signify that the lender will be receiving all of the total accruing interest on the said cash collateral. However, it will pay the borrower an agreed upon the rate of interest.

• Essentially, securities lending is a kind of over the counter market. This is for the reason that it involves the lending as well as borrowing of the securities. Mainly it has the objective of hedging down short-sale positions. The players of securities lending often involved to foundations, mutual funds and pension funds that loan down their security holdings into the qualified borrowers just like the hedge funds, additional asset managers as well as option traders.

• The entire parties will rely on their intermediaries in order to negotiate their transactions and manage up individual risks. Many people also do rely on the Risk Management Software as the additional assurance that they had fully covered their transactions in. Apart from those, traders and inventors will depend more each day upon financial services technology and also with the Risk Management software for such purpose. So, if you are thinking about getting financial services franchise opportunity, you must always keep this thing in mind.

Keep in mind that with financial services franchise, you are dealing out with funds. So, you must always be prepared and guarded about what you have to do in case of unfortunate dealings.

Related Posts

08 Oct, 2018

Starting a Business in Nevada

The 7th most extensive, the 34th most populous, bu...

Know More

01 Oct, 2018

Starting a Business in Missouri

Being the 18th-most populous state of the Union, M...

Know More

25 Sep, 2018

Opening a Business in Michigan

Before starting working on the process of starting...

Know More

20 Aug, 2018

Tips to Starting a Business in Maine

Situated in the northeastern region of the United ...

Know More

19 Aug, 2018

Steps to Starting a Business in Kansas

Situated in the heart of the United States, Kansas...

Know More

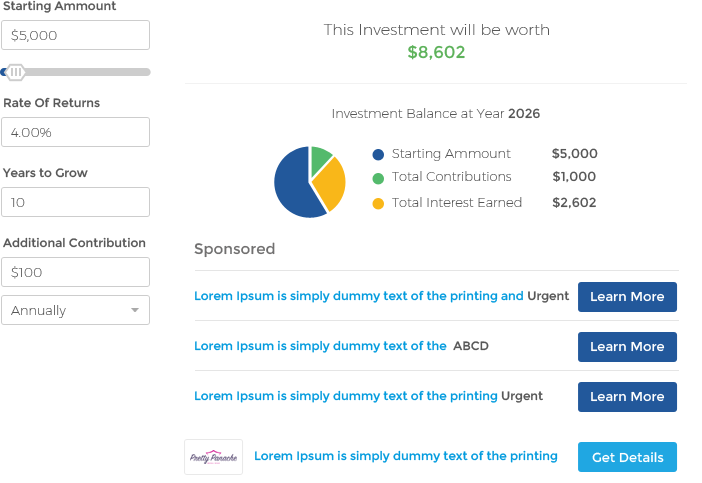

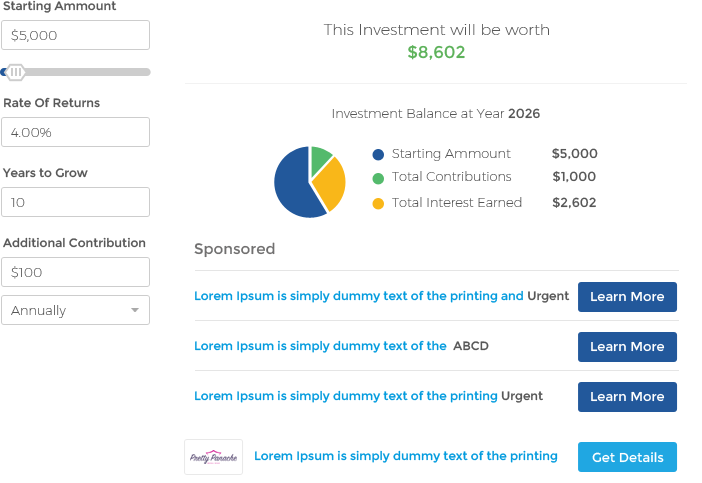

How will your Savings ?