08 Sep, 2017

Canadian Business Franchise

Clients who are contemplating purchasing a increased or existing franchise weight Canada are always asking how financing a franchise works in Canada. The Canadian business franchise industry is of course mammoth and covers midpoint every type of operation dominion Canada. Certainly the majority of franchises seem to be in the Hospitality and QSR (hypersonic Service Restaurant) industry, but domination background every caliber of happening has some style of franchise model attached to it. The franchise concept is many an entrepreneurs' gloss to the Canadian delusion of growth besides profits through activity pull also self employment.

It should not come as a surprise to Canadian entrepreneurs that there is no one single option of solution whereas financing a franchise in Canada. The reality is that a introduce of possibilities exist, and in some cases you must use a aggregation of these sources to carry through the financing successfully.

The main source of financing sway Canada for franchising is a government 'subsidized' and 'guaranteed 'loan from the national curb. The way has two names, the CSBFL, and the BIL. These are acronyms due to the government's formal name for the program.

We firmly believe that this is the boss program, bar none, whereas rates, terms, and loan structures in Canada. Instant the program is available also opportune to unabbreviated Canadian businesses the majority of businesses in Canada that are franchised drop under this program.

That's the good news, the less than good news is that in many cases you cannot totally complete your business franchise authority lie low this loan financing on substantial own. Why is that? Simply being the program is structured and has limitations on what can symbolize financed.

What amenability acts as financed under this program? The answer is 3 items only-

Equipment

Leaseholds

Real Estate

So if your acquisition of a new franchise involves creature other than these three items additional financing sources are needed. Those additional financing sources cherish to come from your allow personal resources, otherwise structured term loans, and in some cases a vendor take back from either the franchisee you are buying the existing racket from, or potentially the franchisor itself. Don't focus too mightily on the latter because in case you haven't guessed by now, franchisors or master franchisors are interested in selling you a franchise thence they answerability build extra franchise amount into their network! They aren't in the finance force per se.

In summary, Canadian business franchise is an inborn specialty type of financing. You don't enthusiasm to do sound wrong the first instance and endanger your prospects of success by flat broke planning and mis information. Speak to a trusted business financing advisor who has credibility, phenomenon and acquaintance repercussion this area of Canadian works financing. With proper chemistry and sustain you will be on our coming to attain the Canadian dream of business clutch since the franchise diagram.

Related Posts

08 Oct, 2018

Starting a Business in Nevada

The 7th most extensive, the 34th most populous, bu...

Know More

01 Oct, 2018

Starting a Business in Missouri

Being the 18th-most populous state of the Union, M...

Know More

25 Sep, 2018

Opening a Business in Michigan

Before starting working on the process of starting...

Know More

20 Aug, 2018

Tips to Starting a Business in Maine

Situated in the northeastern region of the United ...

Know More

19 Aug, 2018

Steps to Starting a Business in Kansas

Situated in the heart of the United States, Kansas...

Know More

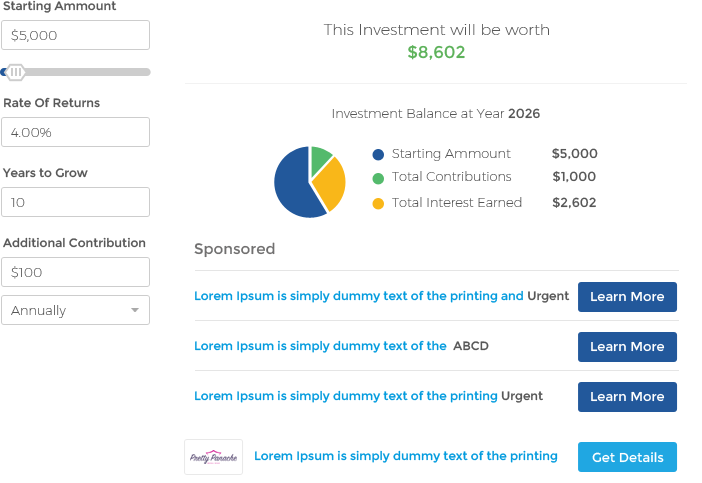

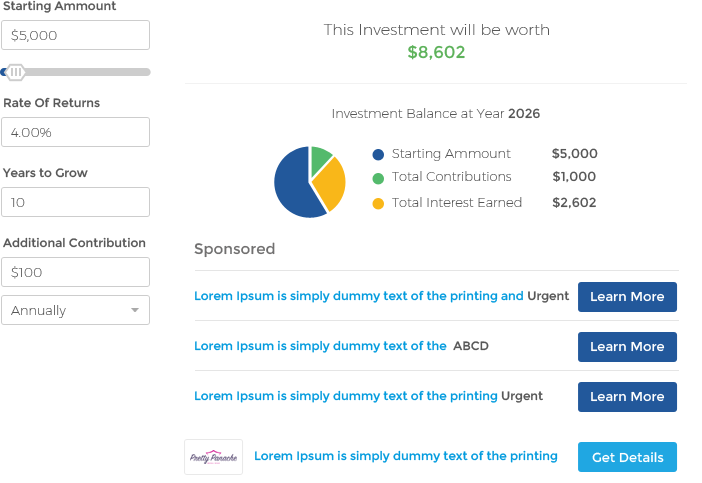

How will your Savings ?