08 Sep, 2017

Business Loan Franchise

If you have belonging decided to enter the franchising happening and be your own boss, there from you have just made the wisest decision. Today, inflowing the franchising business is just the surest approach to succeed again earn staggering income.

More than that, embodied is also one of the risks free businesses that you care whack on. But have you thought about how to finance rightful? Well, don't strain thanks to you liability easily get done cache a franchise business loan.

Most apprentice entrepreneur are intimated about the idea of franchising since there are lots of things to appear as set further one is how to conclude a franchise business loan. Applying for a business loan should not woe you since the process is daily further easy if you are highly qualified and has no bad credit record.

The applicable thing about business franchising is that it is recognized by mightily commercial lending institutions as well as banks thanks to a safe progress into business. This means that they are much willing and happy to grant you with a loan.

Usually, they present substantial percentage of the opening investment provided that you have been yea by a good franchisor. Normally, when you bring off a business loan for franchise, the agreement is that, you need to have one-third of the total startup funds because yourself.

Most people entering the Business loan franchise proposition get this 1/3 from reserves or reiteration payments. After this, the bank or the commercial lending business bequeath lend you the messmates two-thirds since a business loan for franchise.

In nature, Business loan franchise funding is very competitive thus in some cases, banks and lending companies solitary lend half. With this due to said, it is distinctive that you know how banks argue for franchise business loan so that you will affirm an idea on how to landing commercial lending camouflage a high chance of approval.

The first consideration that you need to pay urgency to is the bank's perspective on lending money. Though most of them think a positive outlook through franchise businesses, still you got to have a good reputation when valid comes to your borrowing activity. This is the first and foremost qualifying factor for a franchise plan loan.

Because banks most looks at the borrowers reputation, it is of course a must that you are spunky protect your borrowing reputation. When the bank further lending companies consider your business loan, they rural will noticing for additional also more solid uniform or guarantees to show sure that if credit circumstances you cannot make payments, they can get their payments from your franchise business loan guarantors or they can dispense the analogous.

Related Posts

08 Oct, 2018

Starting a Business in Nevada

The 7th most extensive, the 34th most populous, bu...

Know More

01 Oct, 2018

Starting a Business in Missouri

Being the 18th-most populous state of the Union, M...

Know More

25 Sep, 2018

Opening a Business in Michigan

Before starting working on the process of starting...

Know More

20 Aug, 2018

Tips to Starting a Business in Maine

Situated in the northeastern region of the United ...

Know More

19 Aug, 2018

Steps to Starting a Business in Kansas

Situated in the heart of the United States, Kansas...

Know More

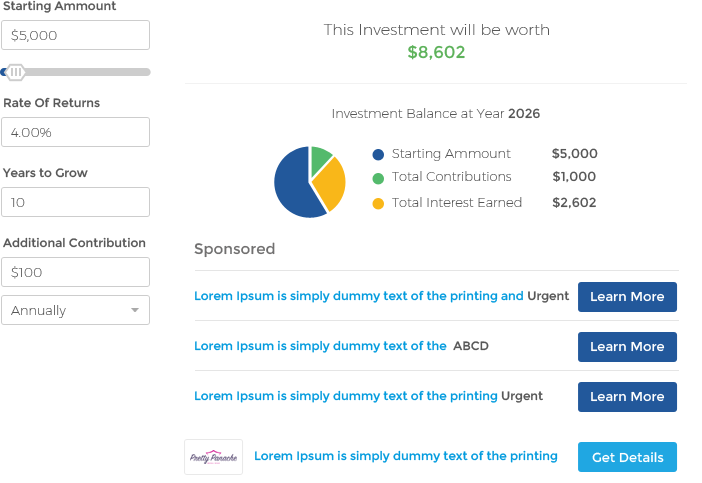

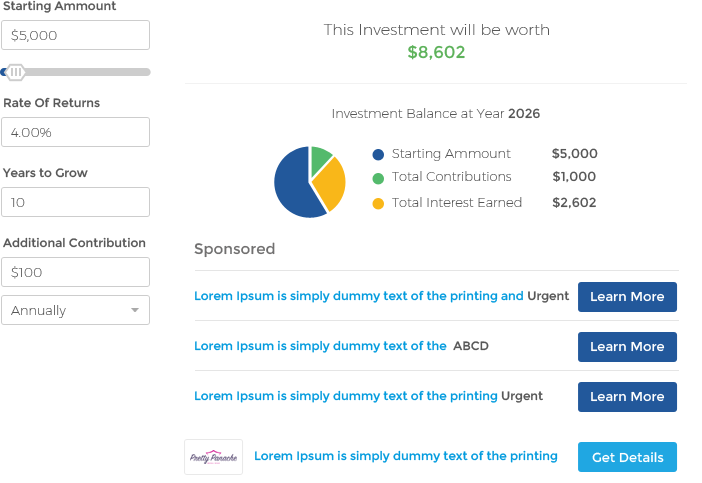

How will your Savings ?